How to Build a Diversified Investment Portfolio: Strategies for Long-Term Success

A diversified investment portfolio is key to achieving long-term financial success. In this blog post, we'll discuss strategies for building a well-rounded portfolio that can withstand market volatility and deliver steady returns.

The Importance of Diversification

Diversification is a risk management strategy that involves spreading investments across various asset classes, industries, and geographies. This approach reduces the impact of poor performance in any single investment on your overall portfolio.

- Benefits of a Diversified Portfolio: Reduces risk, enhances potential returns, and provides stability.

- Reducing Risk and Enhancing Returns: Diversifying your investments helps mitigate risks and improve the likelihood of positive returns.

Asset Allocation

- Balancing Stocks, Bonds, and Alternative Investments: Determine the right mix of assets based on your risk tolerance, investment goals, and time horizon.

- Factors to Consider When Allocating Assets: Consider your age, financial goals, and market conditions when deciding how to allocate your investments.

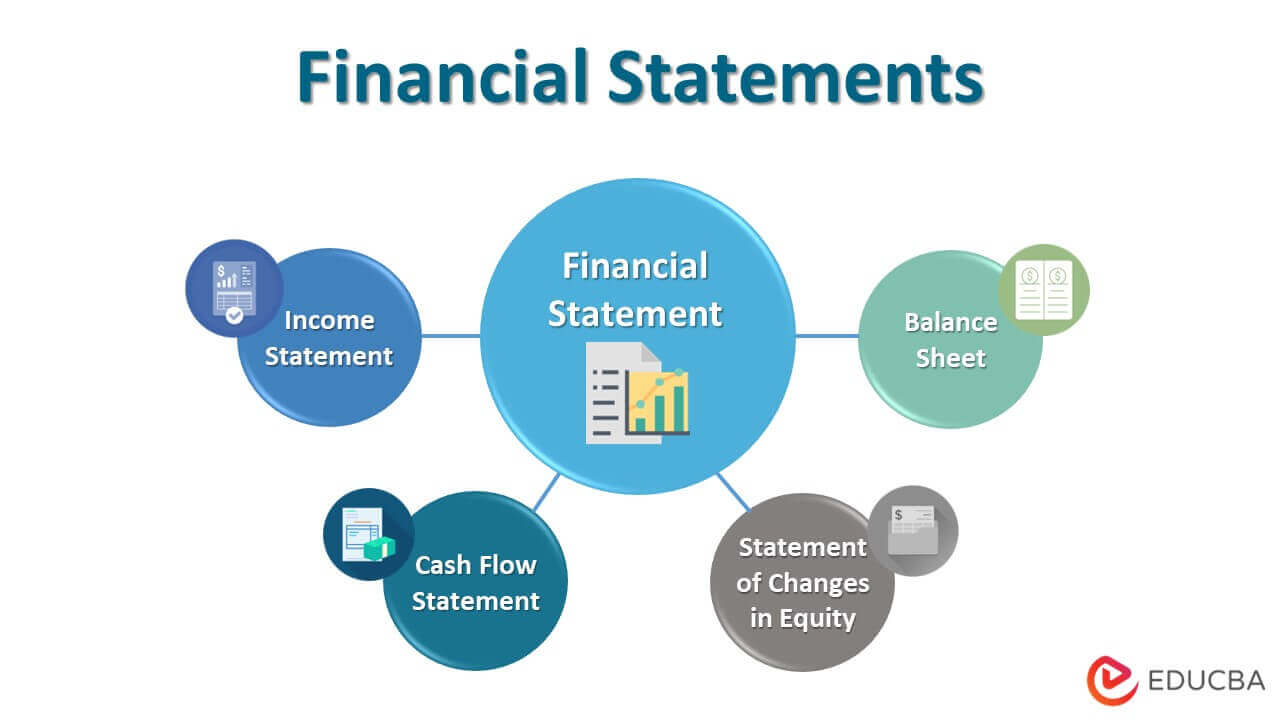

Investment Options

- Overview of Various Asset Classes: Stocks, bonds, real estate, commodities, and alternative investments.

- Pros and Cons of Each Investment Type: Understand the benefits and risks associated with different asset classes.

Regular Portfolio Review

- Monitoring and Adjusting Your Portfolio: Regularly review your investments to ensure they align with your goals and market conditions.

- Rebalancing Strategies: Rebalance your portfolio periodically to maintain your desired asset allocation.

Conclusion

Building a diversified investment portfolio is essential for long-term financial success. By carefully allocating your assets, understanding the benefits and risks of different investments, and regularly reviewing your portfolio, you can achieve steady returns and withstand market volatility. Stay informed and adapt your strategies as needed to maintain a balanced portfolio.

.png)

.jpg)

.jpg)

.png)

English (US) ·

English (US) ·